In a post-pandemic economy that has become truly reliant on digital technology to connect individuals and business partners globally without borders, digital payments that are fast, reliable and safe are critical. And the ramifications when some of these payments failed to go through or to reach suppliers in time, can be far-reaching and damaging for the business.

As cross-border payments become increasingly necessary to organisations operating within the global economy, it is little surprise that business owners and workers come to expect fast, efficient payments – and for repeating transactions, the cheaper the better.

To assess just how effectively cross-border payments are now occurring on a global scale, LexisNexis Risk Solutions released its True Impact of Failed Payments Report, gathering insights from 400 payment executives of financial institutions and leading corporations across the globe, including the APAC region.

The in-depth research, independently conducted by Capgemini Invent in 2022, studied all the major cross-border payment routes worldwide. According to respondents, the three most integral factors when it comes to payments processing is firstly, the accuracy of payment details (as per 40% of respondents). This is followed by the speed of payments processing (32%) plus a low rate of manual labour involved to process it (11%).

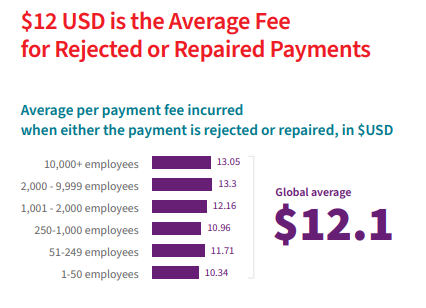

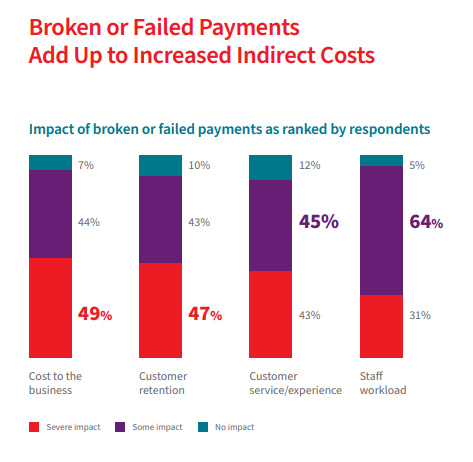

In fact, nearly two-thirds of respondents reported broken or failed payments as having a detrimental effect on internal workloads. Over 70% acknowledged that they are dissatisfied with their current payment failure rate. And with failed payments costing US$12.10 per payment on average, it is also extremely cost prohibitive to face repeat or delayed transactions.

Download the full True Impact of Failed Payments Report here.

“The global economy runs on efficient cross-border payments. Suppliers and consumers expect universally consistent, reliably secure and fast payments experiences over every channel and modality,”

explained Ramanathan Sivabalan, LexisNexis Risk Solutions’ Director of Market Planning, APAC Financial Crime Compliance and Payments division.

“Businesses failing to perfect that balance face the detrimental impacts of repair fees, supply chain disruption, productivity losses, and customer attrition.”

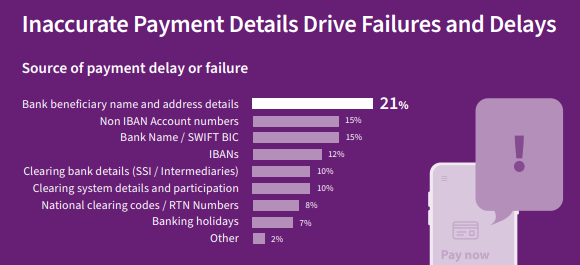

Many respondents reported seeing rejected payments occurring mostly due to currency issues, while the biggest payments delays were usually tied to banks blocking the process due to missing data or incorrect formatting of said data – leading to falling straight-through processing (STP) rates, which measure the full end-to-end automation of cross-border payments.

Globally, an average of 26% account for STP payments, and in APAC the average drops to 24%. Larger companies and financial institutions have higher STP rates than smaller companies, making them more sensitive to failed and delayed payments. With mistaken bank beneficiary name and address details being the primary source of failed or delayed payments, how can financial institutions, fintech companies and corporations get a grip on this telling issue?

“[Payments] friction is not just about the STP rates, it’s about the compliance checks,” elaborated Dalbir Sahota, Director and the Global Head of Know-your-customer and Payments at LexisNexis Risk Solutions. “And it’s about ensuring the end-beneficiary that you’re paying the trusted beneficiary that you think you’re paying.”

Companies can instantly verify that account details are routed to the correct account holders and reduce the risk of fraudulent or inaccurate transactions with LexisNexis Bankers Almanac Validate API, or application programming interface.

Download the full True Impact of Failed Payments Report here.

Download the full True Impact of Failed Payments Report here.

The API works in the background to automatically adds details such as payment network routing info, Standard Settlement Instructions (SSIs), auto-generated IBAN and BIC numbers, and full bank and counterparty bank details so that banks, corporates, and fintechs can quickly verify customer-entered information against payment and compliance rules.

In addition to incomplete data, the Bankers Almanac Validate Safe Payment Verification feature within LexisNexis’ Bankers Almanac Validate will flag, in real-time, any risks associated with payments from mismatching names and account details.

“It can catch mistakes in account numbers and bank codes, and can automatically add the bank code or bank address, even prompt users to add tax codes if needed,” said Ramanathan. “Further, it also helps save users’ time by automatically adding in extra details about the bank and its code. As an API-based service that can easily be integrated into existing payments setup, it also ends up saving significant implementation time and costs.”

Download the full True Impact of Failed Payments Report here.

“So whether you are a bank, whether you are a fintech, whether you are a multinational corporation, at the point that payment is initiated, they can make calls to our API to validate that data in real-time,” said Dalbir. “So easily deployed, easily accessible, and really reducing some of that friction, and increasing STP rates.”

With more than half of study respondents saying that broken or failed payments have both a severe impact on customer retention as well as a serious impact on business costs, compliance, and payments specialist Ramanathan highlighted how corporates with a sizable cross-border, account-to-account payments transactions history should prioritise providing clean, error-free data to their bankers to ensure minimal failed or repaired payments.

“LexisNexis Risk Solutions, with its global reach and dedicated team of payments data specialists collect, update and verify over 300 data points every day, ensuring that our customers stay one step ahead of their competition,” he said. “We cover more than 240 countries, 65,000-plus financial institutions and 190 clearing systems, as part of our in-depth coverage of this dynamic market.”

“So as an organisation, we are a data and analytics company,” agreed Dalbir. “And we deliver that data analytics through our software out to the market” with particular emphasis on a specialisation in payments, and in dealing with customer pain points and friction around the payments journey.

A combination of advanced payment tools and valuable data can help elevate STP rates, significantly lowering failed or delayed payments, and thereby dramatically slashing the number of customers lost as a result of failed payments.

“So really – whether it’s corporates, fintechs, banks – clearly we’re moving more and more to ‘cash is dying’. Essentially, we’re moving continuously to more digital ways, and that includes making payments, internationally and cross-border,” concluded Dalbir. “And I think for any one of these organisations, we have a solution, which will fit their need for strategic growth around making payments faster, safe, and price competitive.”

LexisNexis Risk Solutions’ study, the True Impact of Failed Payments Report, adds further insights and takeaways that can be crucial for businesses and financial institutions to understand how global payment flows move, and how addressing the direct and indirect costs of failed payments can help drive business continuity and sustainable success. Download the True Impact of Failed Payments Report here.