Distributed Ledger Technology (DLT) holds vast potential to address persistent barriers in building out sustainable supply chains. It can significantly boost transparency, mitigate cash inefficiencies, and amplify the utilisation of data to improve processes and sustainability efforts, according to a recent study.

Leveraging underlying DLT, financial institutions that back supply chain participants can automate payments and other business processes quickly and efficiently, increasing overall productivity.

Sustainability and Supply Chain Payments

Sustainable supply chains and financial flows are instrumental in driving progress. By incorporating environmentally and socially positive transactions within supply chains, value chain participants including multinational corporations, banks, and regulators can tackle grassroot impacts, fight environmental challenges, and fuel inclusive economic growth.

However, traditional hurdles related to supply chain processes and payment flows impede progress. A whitepaper titled Deepening Sustainability with DLT by Standard Chartered and the Singapore FinTech Association (SFA) spotlights the transformative power of DLT in enhancing payments in sustainable supply chains.

By combating underlying factors that can deter the United Nations’ Sustainable Development Goals (SDGs), DLT can enrich sustainability within business practices.

Source: World Economic Forum / Bain & Company Supply Chain Traceability Survey, 13 July 2020, as referenced in Deepening Sustainability with DLT, Standard Chartered and Singapore FinTech Association

Overcoming Barriers through DLT

According to Standard Chartered and the SFA, distributed ledger technology solutions have unique features that are adept at addressing barriers to sustainable supply chains.

By tracking, encrypting, validating, and securing each transaction, DLT can enhance traceability and support the verification of sustainability efforts. Lack of visibility and transparency in supply chains often result in unsustainable outcomes and difficulty in tracking, monitoring, and authenticating sustainability initiatives.

A Bain & Company survey in 2021 revealed that about 60% of executives lack visibility into goods and payments beyond their first-tier suppliers. The surge in demand for more transparency in supply chains from corporations and financial institutions fuels the necessity for a solution like DLT.

Impact on Emerging and Developing Markets

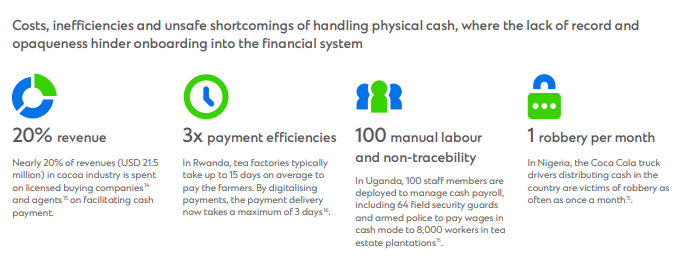

Cash is still a dominant transaction method in many emerging and developing markets. The inherent inefficiencies not only pose economic challenges but also give rise to social issues like theft, fraud, and the absence of formal financial services. These factors often undermine sustainability objectives and exacerbate financial exclusion.

The fragmentation in supply chains and disproportionate costs amplify the challenges, particularly for end suppliers in developing markets who can least afford it, making the goal of shortening supply chains elusive. Data, however, can be a powerful tool in overcoming these issues and measuring sustainability.

Implementing DLT Solutions

Standard Chartered and SFA evaluated different DLT solutions in their resilience to the evolution of the supply chain payments space. The tech offers the potential for full mutual visibility in supply chain transactions.

By recording information about a company’s business practices on-chain, DLT-based systems have the potential to provide valuable insights that can bring clarity to opaque financial and operational processes. Crucially, the data can also inform on inefficient outcomes within sustainable supply chains as well.

DLT can also facilitate automated payments between bank accounts or wallets which are on the blockchain. It could usher in cost efficiencies in micropayments, potentially offering cashless payment methods for traders purchasing supplies.

Banks which support DLT such as Standard Chartered can perform the function of a payment bank, possibly paving the way for smarter storage of value options.

Role of Stablecoins and Smart Contracts

Stablecoins, a form of digital currency, are emerging as a DLT alternative to physical cash in supply chain payments. The process for issuing a DLT token, or stablecoin, involves minting the coin and supporting conversion systems for coin/fiat access. Entities can then initiate DLT coin payments to suppliers and fiat payments to vendors.

Smart contracts are virtual agreements encoded on DLT that can trigger payments automatically once a specific condition is fulfilled. They replace the role of middlemen in e-commerce and supply chains, allowing payments to be released on a blockchain only when a buyer is satisfied.

Looking Ahead: A Vision for DLT

Standard Chartered and SFA see immense potential in the integration of DLT in supply chain payments. With a variety of barriers and DLT solutions, it is evident that approaches will need to vary across different supply chains.

Data validation through DLT can better inform and connect smallholders with financial institutions, buyers, and input producers.

DLT supply chain solutions aim to provide payments and business processes with a wealth of sustainable improvements in the long run, ranging from traceability and visibility, cash efficiency, accountability, enhanced security, improved data quality, institutional grade usability, scalability, financing alternatives to remove market entry barriers, along with digital trust and interoperability.

As we step into a trading future powered by technology, DLT is a positive enabler, steering the way towards efficient and sustainable supply chain payments.

Featured image credit: Image by jcomp on Freepik