There is a Chinese saying that roughly translates to ‘A Tall Tree Catches The Wind’ (树大招风) and this is an adept saying for the Fintech industry. The fintech industry had grown from its nascent stage in 2005 and it is disrupting many existing industries. This tall tree had caught the attention of the regulators internationally known as The Board of the International Organization of Securities Commissions (IOSCO).

IOSCO might be relatively unknown to the general public as opposed to the household names of the Securities Exchange Commission (SEC) in the US or the Monetary Authority of Singapore (MAS) but they set the standards for the securities sector globally. In other words, IOSCO is the regulator of regulators like how the Bank of International Settlement (BIS) is the central bank of central banks. So it is worth looking at the latest IOSCO report for those who are keen to involve themselves in the Fintech industry.

This is their extensive survey of market conditions for the past year after talking to Fintech companies and national regulators. I am not able to over every area but I would cover the more interesting points.

The 8 + 2 Regulatory View of Fintech

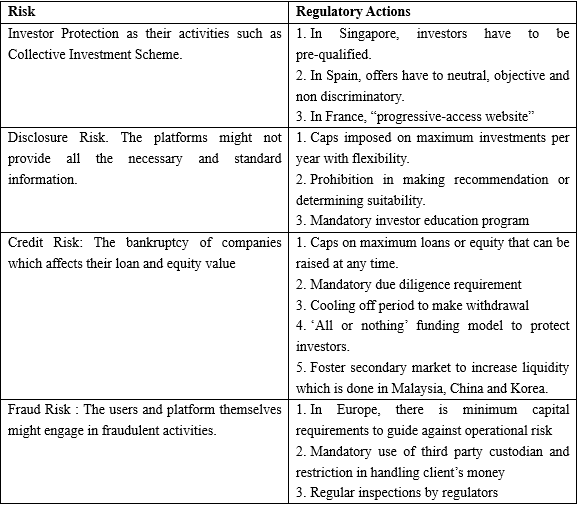

IOSCO starts off by acknowledging the obvious point that fintech had grown tremendously. They categorize Fintech primarily into the eight areas of security, crowdfunding, trading, payments, blockchain, planning, insurance and data analytics.

More importantly, they divide fintech between those that are already making a dent in our lives (e.g. Crowdfunding) against those which are emerging and would impact our lives in the years ahead (e.g. Blockchain). This is important to regulators because the former has well-defined benefits and risks while the latter is unknown.

The Fintech Demonetization Disruption

Demonetization refers to a process which allows users to get access to services which they previously have to pay for free. Notable instances include Skype which demonetize phone calls, Instagram which demonetize photo taking and sharing. Instagram drove Kodak to bankruptcy while Skype forced telcos to change their business models.

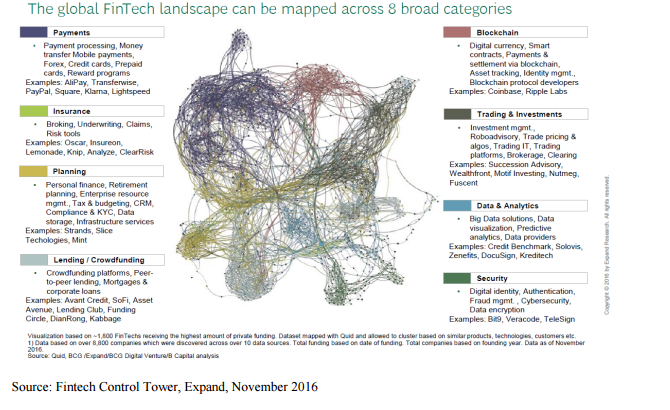

According to IOSCO, fintech is the latest extension of this demonetization. For instance, there are some robo-advisors who provide free advice to clients, equity crowdfunding open access to private equity investment to retail investors. In the United States, there is Circle Up (see the tiny black circle categorized under investment banking) which had raised $310 million for 198 companies in an average of 79 days. The Singapore equivalent would be Fundnel who had raised US$15 million on 15 deals.

While Skype is an example of full demonetization, there are other examples of partial demonetization (making it cheaper) by the disintermediation that such equity crowdfunding and loans crowdfunding services provides. Whether it is full or partial demonetization, they are having an impact. For regulators, they are looking at providing financial stability, investor protection as well as to set international standards.

Balancing Fintech’s Benefits and Risks with Regulatory Actions

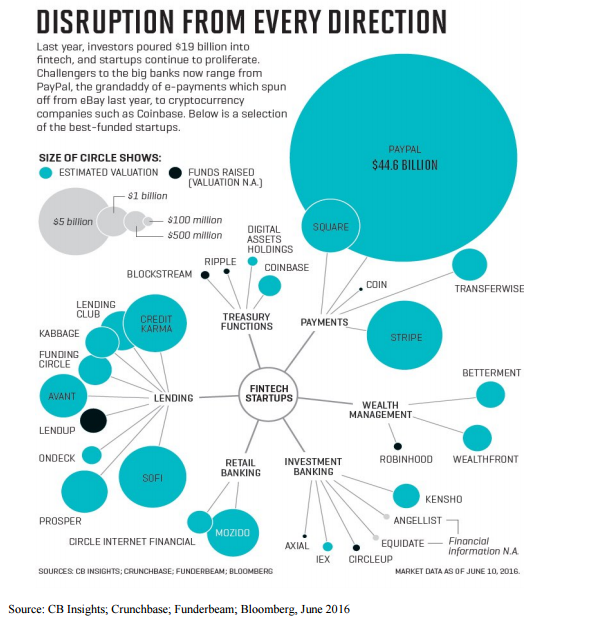

IOSCO looked at how various factors drove the growth of debt and equity crowdfunding. They are propelled by the low interest rates environment, lower technology cost and the opening up of underserved markets. As they grow, they bring along their own benefits, risk and regulatory actions which is summarized in the table below.

The benefits for such crowdfunding platform is clear. They provide greater access to capital either through loans or equity. They provide cost advantage over the bank loan as they don’t have brick and mortar operations. Smaller companies can also skip the expensive IPO process which blocks them from raising funds publicly. This is a market driven system that open funds to woman and minorities which can’t get funds previously. Lastly, they provide investors with more choice and diversification.

The big question for regulators would be how to manage the risk of such an action. The table below shows how regulators are balancing the risk with appropriate regulatory actions across the world.

Conclusion

The fintech industry might be regulated further in the future as regulators understand their business model better. Right now, regulators don’t want to over-regulate in case they kill of the industry which had brought about benefits to society. On the other hand, they don’t want a few bad apples to destroy the public’s trust in the industry.

The emergence of IOSCO means that there will be standardization for equity and debt crowdfunding globally in the future subjected to local customization. For better or worst, the fintech tree is tall and regulators are keeping an eye on them.

Featured picture source – Pixabay.com