Indonesia

Gojek Makes Financial Push in Indonesia With 22% Stake Acquisition in Bank Jago

Gojek has acquired 22% of Indonesia’s Bank Jago as part of a strategic partnership to offer financial services in Indonesia. The investment, made through Gojek’s payments and financial services arm, will reportedly be worth 2.25 trillion Indonesian rupiah (US$159 million).

Read MoreGrab Doubles Down in Indonesia With Investment in E-Wallet LinkAja and New Tech Center

Grab doubles down on Indonesia by leading a Series B funding round worth US$100 million in Indonesian e-wallet LinkAja and the establishment of a new Tech Center. The funding round includes investments from Telkomsel, BRI Ventura Investama, and Mandiri Capital

Read MoreBukalapak and Microsoft Join Forces to Enhance the Indonesian E-Commerce Space

Microsoft and Bukalapak, an Indonesian e-commerce platform, have formed a strategic partnership where the latter will adopt Microsoft Azure as its preferred cloud platform. Microsoft will also make a strategic investment in Bukalapak. “This partnership signals a deep collaboration with

Read MoreCrowded Indonesian Market: 51 Licensed E-Money Providers

Bank Indonesia, the country’s central bank, has issued two new e-money licenses so far this year. These two new additions bring the total number of licensed e-money providers to 51, comprising 14 banks, and 37 non-bank providers, according to data

Read MoreInsurtech Platform Igloo Lands Partnership With Union Bank and Akulaku for Micro-Insurance

Igloo, Singapore-headquartered insurtech firm, announced partnerships with Union Bank of the Philippines and Indonesia’s Akulaku to offer micro-insurance policies. Akulaku is one of Indonesia’s most well-funded fintech startups who is best known for their “buy now, pay later” service. Igloo

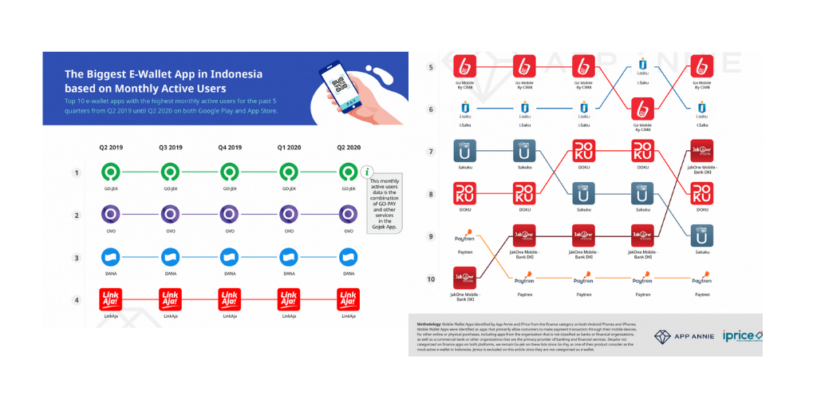

Read MoreWho is The Winner in Indonesia’s E-Wallet War?

iPrice Group collaborated with App Annie, an app market data and insight company, to summarise updates on e-wallet app platforms in Indonesia from Q2 2019 until 2020. Here are 7 major findings on e-wallets in Indonesia: 1. Local Players Dominate

Read MoreUOB Launches Digital Bank TMRW in Indonesia

UOB Indonesia launched TMRW, its digital bank to serve the Indonesian market as part of the group’s strategy to accelerate growth of its regional customer franchise, which follows their initial launch in Thailand in 2019. A key feature that they

Read MoreAmar Bank Launches Senyumku a “Digital-Only Bank” using Google Cloud

Amar Bank announced its collaboration with Google Cloud in introducing Senyumku, which they described as a digital-only bank launched in the Cloud. The collaboration is supported by FIS Cloud and Infofabrica, to enable the bank to utilize data analytics intelligence

Read MoreOVO’s P2P Lending Arm Taralite Secures License from Indonesia Financial Services Authority

OVO , a leading payments and financial services app in Indonesia, announced that its lending arm, Taralite, a peer-to-peer (p2p) lending services provider, has obtained a business license from the Indonesia Financial Services Authority (OJK). This decree elevates Taralite from

Read MoreFacebook and Paypal Invests in Gojek to Join its Bid to Boost Digital Payments

Gojek announced today that Facebook and PayPal have joined Google, Tencent and others as investors in its current fundraise. This new investment will support Gojek’s mission to boost Southeast Asia’s digital economy, with a focus on supporting payments and financial

Read More