Posts From Fintech News Singapore

5 E-Commerce Payment Trends to Watch out for in 2021

COVID-19 has accelerated consumers’ shift to digital channels with online shopping volumes reaching new highs around the world. In Southeast Asia, e-commerce has emerged as the growth engine for the region’s digital economy, growing 63% to reach US$62 billion in

Read More5 Stories that Shaped Fintech in Singapore in 2020

Despite global turbulences caused by COVID-19, the Singapore fintech industry remained resilient in 2020 on the back of new favorable rules, fintech initiatives from the government, and increased demand for digital solutions. Over the past five years, the Singapore fintech

Read MoreRazer Fintech Partners Rely to Provide Pay Later Solution for Its Merchants in South East Asia

Razer Fintech has partnered with Rely, a Singapore-based Buy Now Pay Later (BNPL) service provider, to offer BNPL services in South East Asia to merchants registered under Razer Merchant Services (RMS), its B2B solution. Through this partnership, RMS’ merchants will

Read MoreAuthentication Is Done. What About Identification?

Airome Technologies, a Singapore-based developer of cybersecurity solutions for digital banking and e-document management systems, has been working with authentication and transaction confirmation technologies for a while, creating advanced products in this field. However, with the pandemic situation the company

Read MoreHow to Get Customer Messaging Right in Financial Services

If fintech brands aren’t mindful of today’s looming threats, they may find themselves losing out not just to banks, but to non-financial brands. Think Apple’s wildly successful credit card debut, with over $10 billion dollars of extended credit within two

Read MoreFunding Societies Bags Investment From Samsung Ventures

South East Asia’s P2P financing platform, Funding Societies also known as Modalku in Indonesia, announced that Samsung Venture Investment Corporation has invested in its latest funding round. Funding Societies intends to expand its technology team across to tap tech and

Read MoreeKYC to Fuel Asia’s Digital Banking Revolution

In Southeast Asia, governments are pushing for greater adoption of digital financial services by introducing favorable regulations on digital onboarding, digital banking, and more, experts said on December 3, 2020. During a virtual panel discussion with Fintech News last week,

Read MoreCarro and MSIG Launches AI-Powered Behaviour Based Insurance to Reward Safe Drivers

Carro, South East Asia’s automotive marketplace, has launched a behaviour and usage-based car insurance (UBI) in partnership with Mitsui Sumitomo Insurance Group Holdings (MSIG), a member of MS&AD, a Japanese insurance company. Drivers in South East Asia will enjoy tailored

Read MoreStanChart Inches Closer to Singaporean Digibank After New Classification by MAS

Standard Chartered Bank (Singapore) Limited (SCBSL) has been awarded enhanced Significantly Rooted Foreign Bank (SRFB) privileges by the Monetary Authority of Singapore (MAS), indicating that it is making moves for a second digital-only bank after its launch of Mox. The

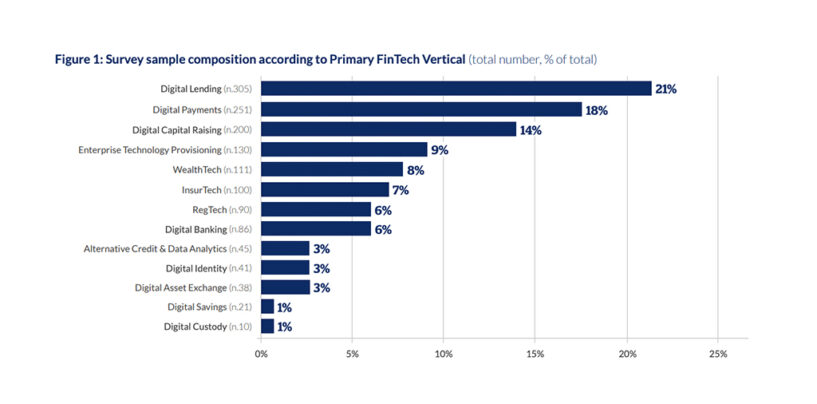

Read MoreCOVID-19 Has Given All Fintech Verticals A Boost Except Digital Lending

The COVID-19 pandemic has given the global fintech market a boost, with firms in areas including digital custody, digital asset exchange, digital savings, wealthtech and digital payments recording above-average increases in transaction volume in H1 2020, according to a joint

Read More