Posts From Fintech News Singapore

All The Major Singapore Fintech Festival Announcements At a Glance

The Singapore Fintech Festival (SFF) 2020 took place between December 7 to 11 this year, featuring a unique hybrid format that combined a 24-hour online platform with satellites events around the world. The 2020 week-long fintech gathering included more than

Read MoreHere Are the Winners of MAS’ 2020 Global Fintech Innovation Challenge

The Monetary Authority of Singapore (MAS) has announced the results of the MAS Global FinTech Innovation Challenge 2020. The MAS Global FinTech Innovation Challenge comprises 2 distinct competitions; MAS Global FinTech Hackcelerator and MAS FinTech Awards with a total cash

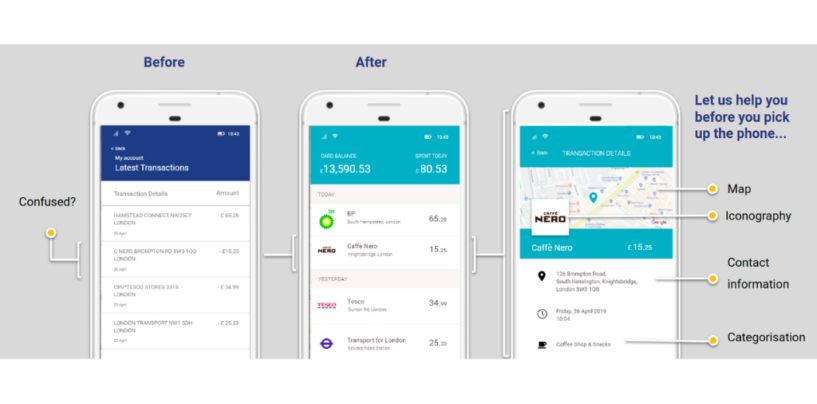

Read MoreVisa Expands Partnership With Snowdrop to Unveil Location-Enriched Services in APAC

Snowdrop Solutions unveiled a partnership with Visa to provide location-enriched services to banks and financial services firms throughout the Asia Pacific region, enabling consumers to better see and understand where they spend their money. The two companies said they would

Read MoreDBS Launches Crypto Services With SGX Holding a 10% Stake

DBS announced that it will set up a digital exchange with Singapore Exchange (SGX) holding a 10% stake, enabling investors to tap into a fully integrated tokenisation, trading and custody ecosystem for digital assets. Crypto trading activities is said to

Read MoreSingapore and Hungary Central Banks Ink Fintech Cooperation Agreement

The Monetary Authority of Singapore (MAS) and the Magyar Nemzeti Bank (MNB) has signed a Co-operation Agreement (CA) to strengthen cooperation in fintech innovation between Singapore and Hungary. The CA sets out a framework for fintech collaboration between both countries.

Read MoreBangkok Bank Co-Develops Thai Language AI Chatbot With Pand.ai

Bangkok Bank PLC announced the launch of its Thai language Artificial Intelligence (AI) powered chatbot that was built in-house in a joint collaboration with Singapore-based fintech startup Pand.ai. The chatbot called TT01 was a result of Bangkok Bank’s innovation programme,

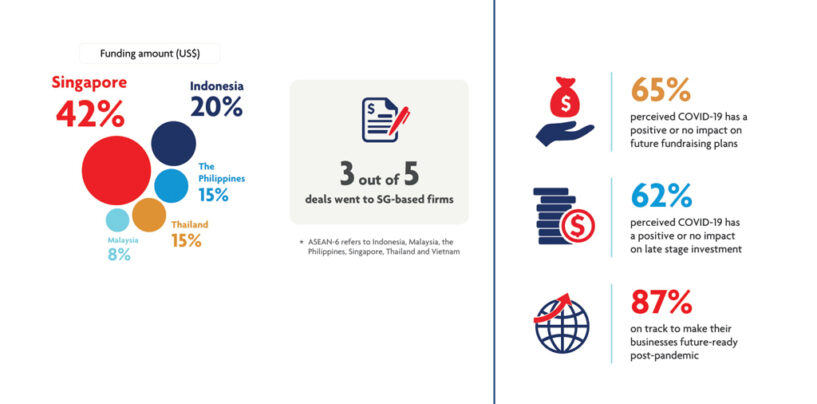

Read MoreFour in Five Fintech Firms in ASEAN Set on Expanding Despite COVID-19

Despite disruptions brought about by the COVID-19 pandemic, four in five fintech firms in ASEAN will push ahead with their expansion plans in the next two years, this is according to a report by UOB, PwC and the Singapore Fintech

Read MoreMastercard and Pine Labs Plans to Expand ‘Pay Later’ Solution in South East Asia

Mastercard and Pine Labs will launch their integrated “pay later” solution in five more South East Asian markets early next year. This will offer consumers the flexibility of zero-interest instalments on purchases, expand business for merchants and connect banks, fintechs,

Read MoreMAS and Ministry of Health Developing Data Sharing Platform for Faster Insurance Claims

Insurance is a crucial aspect of every individual’s financial planning, while much of the world has been focusing on how to get more people insured, little discussions have been had surrounding the pain points and inefficiencies of the insurance claim

Read MoreMastercard Partnership Enables You To Turn Your Wearables into Secure Payment Devices

Mastercard, in partnership with MatchMove, a Singapore-based ‘Banking-as-a-Service’ provider and Tappy Technologies, a wearable payment integrator, have introduced tokenisation into a small, flexible chip which can be attached to a range of battery-less wearables and accessories such as watchstraps or

Read More