Archive

Telstra Ventures Invests in C88 Financial Technologies

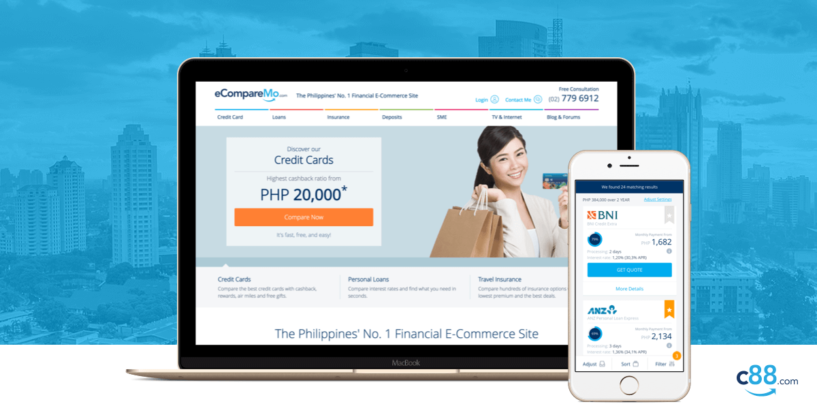

Telstra Ventures today announced a strategic investment as part of leading a Series-B funding round in C88 Financial Technologies Pte Ltd, which owns and operates the largest consumer financial websites in Indonesia and the Philippines. Matthew Koertge, Managing Director of

Read MoreRegtech Poised to Thrive; Requires New Regulatory Framework

Regulation compliance is time consuming and expensive for both financial institutions and regulators. According to policy analysis firm Federal Financial Analytics, the six largest banks in the US spent as much as US$70 billion on compliance in 2013. That’s twice

Read MoreDesigner Brings Blockchain To Fashion

BABYGHOST’s 2017 Spring and Summer release takes to the streets with a twist of new age oddity as the fashion brand has partnered with VeChain, a digital identity solution, to give every piece of the BABYGHOST collection a futuristic depth.

Read MoreThe First FinTech And IoT Focused Accelerator in Malaysia

Finnext Capital, an innovation ecosystem enabler announced a partnership with Cyberview, to develop Finnext Accelerator, which is a collaborative effort between government, corporates, entrepreneurs and venture capitalists to accelerate and nurture Fintech and IoT focused tech startups. Selected startups will

Read MoreBlockchain Tech ‘Pose Certain Risks And Uncertainties,’ Say US Regulators

Although blockchain technology could help improve efficiency and reduce risks associated with trading, clearing, settlement, and custody services, distributed ledger systems “pose certain risks and uncertainties” which market participants and regulators need to monitor, according to a group of US

Read MoreTop 24 Fintech Startups by Forbes Philippines

Forbes Philippines has published a list of the country’s leading fintech startups in the magazine’s October 2016 issue. The list includes 24 fintech startups in the country. The magazine also noted that the footprint of fintech startups is rapidly expanding in

Read MoreCustomers’ Lack of Trust and Desire For Innovation Are Eroding Bank Relevance

Forty percent of 55,000 consumers (including 1,007 in Singapore, 2,025 in Malaysia and 2,053 in Indonesia) surveyed worldwide report decreased dependence on their traditional bank and increased excitement about alternatives, according to the EY 2016 Global Consumer Banking Survey. A

Read MoreIndonesia’s Digital Financial Services Growth Potential

Only 36% of Indonesia’s population is connected to formal financial institutions, leaving an estimated 110 million unbanked citizens due to banks’ high fees, lack of consumer trust and long distances to branches. GOVERNMENT ASSISTANCE AND SUPPORT The Indonesian Government is

Read MoreThe Philippine Fintech Startup Report and Landscape

With a population of over 100 million people, an Internet penetration rate of 46.5% and a mobile phone penetration rate of 87%, the Philippines is believed to be a growth area for fintech solutions and ventures, notably considering its emerging

Read MoreDigital Technologies And Fintechs to Drive Financial Inclusion in Asia

With an estimated 2 billion adults and 200 million micro, small and midsize businesses (MSMEs) worldwide considered as unbanked or underbanked, financial inclusion has emerged as a critical development challenge and an opportunity for fintechs. The unbanked are those who

Read More