5 Top Fintech Trends in Asia Pacific 2024 – Here’s What’s Shaping the Region

by Johanan Devanesan January 9, 2024The fintech landscape in the Asia Pacific (APAC) region has been evolving at a remarkable pace, with start-ups and established companies redefining how financial services are delivered and consumed. As we enter 2024, there is a sense of cautious optimism prevailing, as the fintech trends in Asia Pacific lean towards a more data-driven and analytical approach to fintech development, and fostering balanced market growth.

Today, we will explore five top fintech trends in Asia Pacific for 2024, supported by statistics and insightful information. These trends offer both opportunities and challenges for established financial institutions and innovative start-ups, reflecting the ever-evolving nature of the industry.

Embracing Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are gaining substantial traction, it is considered by many observers as on of the top fintech trends in Asia Pacific . These cutting-edge technologies are revolutionising various facets of financial services, ranging from personalised banking experiences to more sophisticated risk assessment models. In 2024, AI-driven chatbots and virtual assistants are expected to provide enhanced customer support and financial advice.

The application of AI and ML extends beyond customer service; it also plays a pivotal role in detecting and preventing fraud — a critical concern in the digital finance realm. As these technologies continue to mature, they are poised to reshape the industry in ways that were previously unimaginable.

Throughout 2023, there was a remarkable surge of interest and investment in AI and ML, both within and beyond the financial industry, and the IDC projects that at current growth rates, artificial intelligence spending in APAC will grow to US$78.4 billion by 2027.

In contrast to recent tech fads like NFTs and the metaverse, the focus on AI and ML is well-justified. Experts and industry insiders hold a bullish outlook on the potential of these technologies to revolutionise finance, including in data-driven markets analysis and wealth management AI advisors.

While the initial hype around AI may subside, it is an area where the potential is likely to match, if not exceed, expectations. The transformative power of AI and ML holds the promise of a more efficient and customer-centric financial landscape.

Cryptocurrencies Market Resurgence

The resurgence in cryptocurrency prices and the anticipated halving of Bitcoin in mid-2024 has reignited interest in the potential of distributed ledger technology to reshape the financial landscape. In 2024, we anticipate a substantial increase in institutional adoption of cryptocurrencies, particularly in the APAC region.

Traditional financial institutions are showing a growing interest in digital currencies, a trend driven by market dynamics and technological advancements. Fiona Murray, Vice President and Managing Director for the APAC region at Ripple, has forecasted a substantial increase in institutional adoption of cryptocurrencies in 2024.

This prognosis is particularly timely, as the digital currency market is currently experiencing heightened interest from traditional financial institutions, with a particular emphasis on the APAC region. Singapore’s DBS, for instance, became one of the few Asian banks to introduce crypto trading services via its DBS Digital Exchange (DDeX) for corporate and institutional investors, as well as for DBS wealth clients that are accredited investors.

Nonetheless, it is important to recognise that cryptocurrencies still have much to prove in the coming year. Some companies that have relied heavily on digital currencies have faced considerable challenges, while venture capital interest has shifted. The concept of tokenisation, which is generating significant interest, is transforming trading and asset management across various sectors, from real estate to company shares.

However, much of this space is still in search of a problem to solve. While the potential is evident, practical applications for digital currencies and blockchain technology are still emerging. It remains to be seen how the industry will evolve and address these challenges in 2024.

Upsurge of Blockchain and DLT Applications

Originally brought into the spotlight by cryptocurrencies like Bitcoin, blockchain technology is now making significant inroads into traditional financial systems. Blockchain promises increased transparency, security, and efficiency across various applications, from payment transactions to smart contracts.

A notable indicator of this shift is the growing preference for cross-border payment solutions built upon blockchain technology, particularly within the APAC region. This trend signifies a significant departure from conventional payment methods, signalling a growing confidence in the security and efficiency of digital currencies.

Several nations within the APAC region, including Singapore and Japan, are actively exploring Web3 digital assets and stablecoins. The central bank of Singapore has announced plans to pilot the issuance and use of wholesale central bank digital currencies (CBDCs) in the coming year. This initiative aims to facilitate real-time cross-border payments and settlements, marking a significant step forward in the future of payments.

While wholesale CBDCs differ from retail CBDCs, which cater to everyday transactions, they represent a promising evolution in the realm of digital currencies. It is only a matter of time before consumer e-commerce applications built around CBDCs become available to the public.

Furthermore, many APAC governments and central banks are actively exploring CBDC and blockchain-based digital identity frameworks. In 2024, we can expect to witness more practical pilot projects and use cases that incorporate digital currencies and financial data on the blockchain, furthering the adoption and integration of these technologies into the financial sector.

Digital Banks Gaining Momentum

Digital banking is an area poised for substantial growth in Asia, driven by consumer demand for more convenient and accessible banking services. These digital banks, unburdened by the legacy systems of traditional banks, offer a more agile and customer-centric approach. This trend is especially pronounced in markets with a large unbanked or underbanked population, such as the digital banks in Indonesia and the Philippines, providing them with access to financial services that were once out of reach.

One of the intriguing developments within this fintech trend is the success of APAC digital banks in developed markets. Historically, it was often assumed that there was limited opportunity for digital retail banks to make significant headway in markets like Singapore or Hong Kong. However, what was underestimated was the power of ecosystems.

For instance, Singapore’s Trust Bank leveraged the millions of individuals affiliated with the NTUC family to drive initial usage. This ecosystem continues to play a crucial role as individuals seek discounts, financial services, and deals. It illustrates the symbiotic relationship between digital banks and established communities.

Sustainability as a Driving Force Amid Shifting Funding Landscape

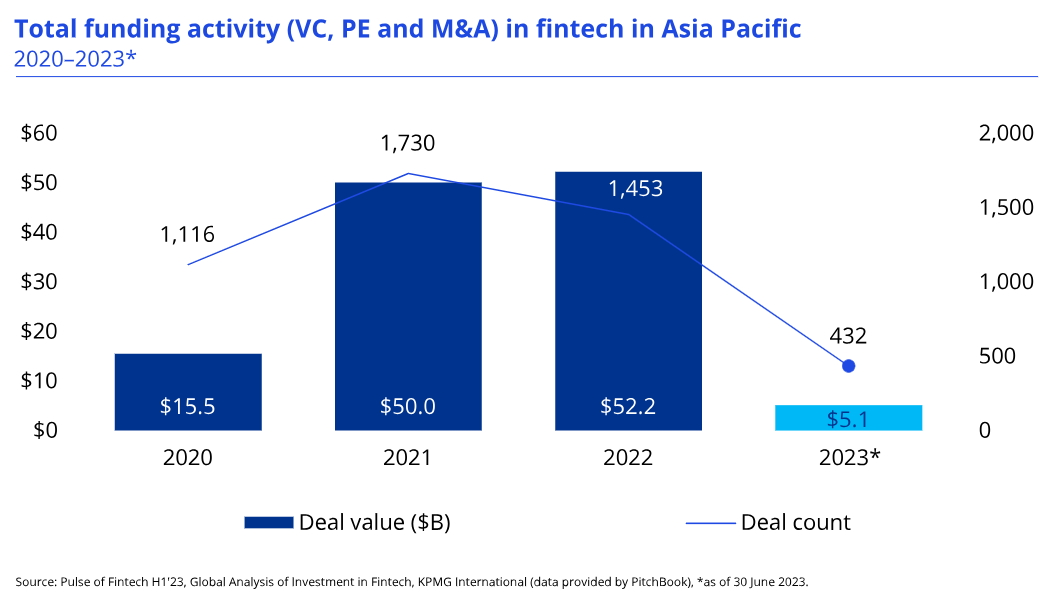

One of the most notable regional trends in the APAC fintech landscape is the evolving funding environment for startups. While there was a notable surge in venture capital investments leading up to 2022, the focus is now shifting towards sustainability and long-term progress, a shift that was accentuated by the challenges faced in the fintech funding market in 2023. This trend is expected to become even more pronounced in 2024.

According to the KPMG Pulse of Fintech H1’23 study, fintech funding in the APAC region declined from US$6.7 billion in the first half of 2022 to US$5.1 billion in the first half of 2023. This marked contrast with the record-breaking six months of funding in 2022, underscores the shifting dynamics within the industry.

While the decline in overall funding is evident, certain deals have stood out. Notably, China-based consumer finance services company Chongqing Ant Consumer Finance raised US$1.5 billion during H1’23. However, other deals in the region during the same period were considerably smaller, with the next biggest deals in the APAC region including the US$304 million buyout of India-based SME lending company Vistaar Finance by PE firm Warburg Pincus, the US$270 million raise by Singapore-based credit services firm Kredivo Holdings, and a US$200 million raise by India-based digital lending platform Creditbee.

As one of the most notable fintech trends impacting the APAC region in recent years, the shift towards sustainability and long-term growth is leading investors to become more discerning. They are now prioritising start-ups with robust business models and clear paths to profitability. Additionally, investors are seeking companies with the potential for regional or even global scalability. This shift signifies a move away from the previous growth-at-all-costs mentality, towards a more balanced approach.

Fintech Trends in Asia Pacific to Look Ahead to in 2024

As the fintech market becomes increasingly competitive, companies are actively exploring new specialisations and capabilities through strategic partnerships with complementary businesses. This trend extends beyond fintech companies; traditional financial institutions are also recognising the need to incorporate modern financial technologies to remain relevant and to strategically reduce the risks associated with extensive research and development investments.

Hence, APAC fintech observers expect the prevailing trends affecting the landscape in 2024 to be characterised by the increasing adoption of AI and ML, a resurgence in the cryptocurrency market, the upsurge of blockchain applications, the growth of digital banks, and a shift towards sustainability in funding. These trends reflect the dynamic nature of the industry, offering both opportunities and challenges for stakeholders in the financial sector.

The year ahead promises to be a period of transformation and adaptation, where the most innovative and resilient players will thrive. With AI and ML leading the way in reshaping customer experiences and security, digital currencies exploring uncharted territories, blockchain forging new paths in transparency, and digital banks meeting the demands of consumers, the APAC fintech sector is poised for an exciting and dynamic future.