Lending

Unqualified P2P Chinese Platforms Under New Policy

The China Banking Regulatory Commission (CBRC) on 24th August officially released “Interim Measures for Administration of Peer-to-Peer Lending Information Intermediaries” (hereafter referred to as “Measures”). An information intermediary rather than a financial institution defines a P2P lending institution or platform.

Read MoreChaos Among Chinese School Students Taking Out Unregulated Loans

While China’s Banking Regulatory Commission (CBRC) doesn’t allow banks to issue credit cards to college students below 18, they tend to find alternative methods of paying their studying loans, like “naked” loans through P2P lending platforms. There have even been

Read MoreNew Fintech Startup for the Philippines: Launch of Leverage.ph – Loans, Investments and Financial Strategies For Small Businesses

MicroGroup Lending Corporation, a leading lending institution, has embarked on a joint venture with Incubix Technologies in order to provide Leverage.ph that is set to improve the financing industry for small businesses. MicroGroup will provide financial expertise and insights for

Read MoreFirst Singapore SME Lending Platform to Provide Investor Protection

Validus Capital, an SME lending platform, has announced it will be the first platform in Singapore to provide investor protection for their invoice financing loans. Partnering with insurance provider, EQ Insurance, Validus Capital will join the ranks of China’s Lufax in Asia, which

Read MoreThe Most Anticipated Fintech Events in Asia – Second Half of 2016

Fintech News will update you once again about the most anticipated Fintech events in Asia in the second half of 2016. These events vary from Fintech in general, Lending, Digital Finance, Customer Experience, Mobile Payments, or IOT, which gather top industry

Read MoreAsia’s Top 7 Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending is the loan of money to individuals or businesses through online services that match lenders directly with borrowers without going through a traditional financial intermediary such as a bank. P2P lending first appeared in 2005 with the

Read MoreCapital Springboard Peer-to-Peer Invoice Financing Platform Launched in Singapore

Access to invoice financing, an emerging asset class, where accredited investors buy yet-to-be-paid invoices and earn an attractive return when invoices are paid Backed by Centurion Portfolio Managers, London based FCA regulated investment advisors, with many years’ experience in Alternative

Read More4 Popular Fintech Topics and What You Should Not Miss

FinTech is undeniably one of the most promising industries in recent time. Find out the most discussed topics and what you should not miss. The Blockchain Technology It is only a matter of time before the broader financial services and

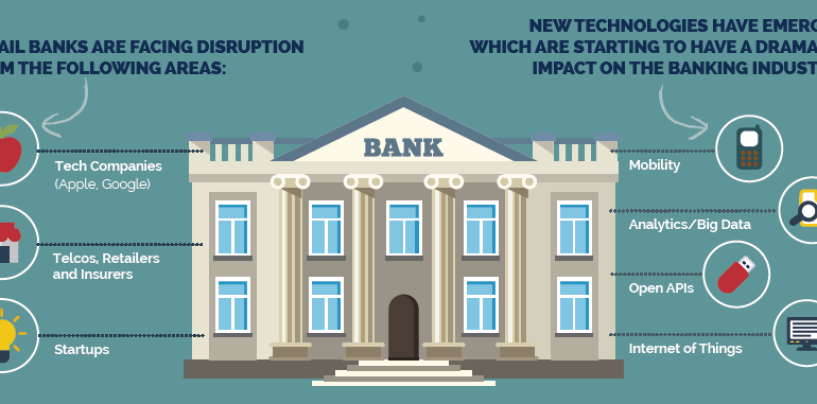

Read MoreInfographic: How Retail Banks Are Adapting to Fintech Disruption

Banks have ignored consumer demands for too long and their legacy infrastructure needs to be fixed thoroughly. The effect of disruption is very big across the banking sub-sectors, especially for retail banks. Retail banking segments such as lending, remittances and payments

Read MoreZidisha: Crowdfunded Microloans to Reduce Poverty

In the context of financial inclusion, fintech holds boundless potential. Fintech players, who use software and digital platforms to deliver financial services to consumers, are helping in making financial products and services more attainable than ever. According to Julia Kurnia,

Read More