Tag "PayNow"

HitPay Rolls Out Mass Payout Services in Singapore, Malaysia, and the Philippines

HitPay, a provider of commerce infrastructure for businesses, has launched its mass payout services in Singapore, Malaysia, and the Philippines. This new service enables businesses to pay workers, contractors, partners, and suppliers efficiently through HitPay’s platform. It supports various payment

Read MoreTop 10 Highlights from Last Week’s Singapore Fintech Festival

The seventh edition of the Singapore Fintech Festival (SFF), one of the world’s largest annual fintech events, kicked off on October 31, 2022 as an in-person event at the Singapore Expo. This year’s event, themed “Building Resilient Business Models amid

Read More3 Ways Singapore Is Trailblazing the Cross-Borders Payments Scene

As digitalization blurs the physical borders between countries, it is estimated that the total global cross-border payment flow can surpass USD156 trillion by 2022. In the European Union (EU), the Single Euro Payments Area (SEPA) is a timely solution that

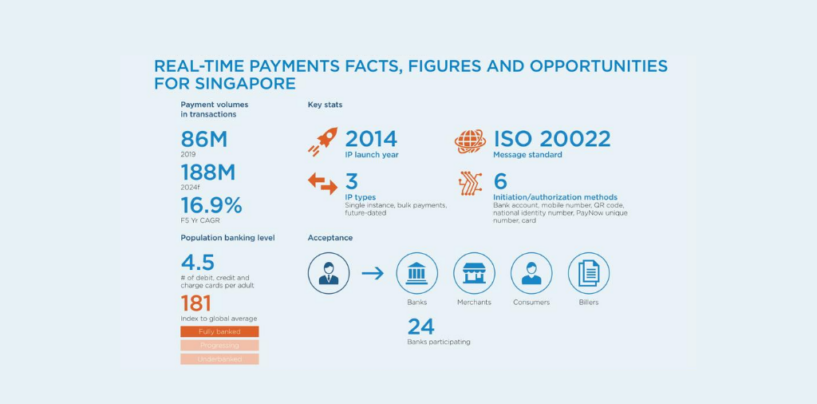

Read MoreReal-Time Digital Payments Volume Surges 48% in Singapore

Singaporeans are moving away from paper-based payments and embracing real-time digital payments and mobile wallets, a shift that has accelerated with COVID-19, a new report by ACI Worldwide Real-Time Payments and GlobalData says. 2021 Prime-Time for Real Time, a global

Read MoreNon-Bank E-Wallets GrabPay, LiquidPay and Singtel’s Dash to Offer PayNow

The Association of Banks in Singapore (ABS) announced that for the first time PayNow has been made available to three non-bank Financial Institutions (NFIs) namely Grab Financial Group, Liquid Group and Singtel’s Dash effective from today onwards. The addition of

Read MoreSingapore and Thailand to Enable Cross Border Payments Using Only Mobile Numbers in 2021

During the Singapore Fintech Festival 2020, Ravi Menon, Managing Director, Monetary Authority of Singapore (MAS) announced that the regulator has made significant headway in the linkage between Singapore’s and Thailand’s national payment systems; PayNow and PromptPay respectively. Monetary Authority of

Read MoreE-Wallets Will Soon Have Access to E-Payment Platforms FAST and PayNow

The Monetary Authority of Singapore (MAS) announced that non-bank financial institutions (NFIs) that are licensed as a major payment institution under the Payment Services Act, will be allowed to connect directly to Fast and Secure Transfers (FAST) and PayNow from

Read MorePayNow Increases Default Limit for Ad-Hoc Transactions up to S$200,000

The Association of Banks in Singapore (ABS) announced that all of the nine participating PayNow banks will allow ad-hoc transactions of at least S$5,000 or more. This will enable customers to use PayNow, an electronic fund transfer service, for a

Read MoreBring Colour Back to the South East Asian Payments Landscape

For the global banking and finance industry, Southeast Asia (SEA) has established itself as a key region in terms of innovation and growth opportunities in real-time payments. Underlying this is the fact that SEA’s internet economy is projected to triple

Read MorePayNow QR is The Latest to Adopt SGQR, Singapore’s Unified Payment QR Code

The Association of Banks in Singapore (ABS) announced yesterday that PayNow QR will adopt the Singapore Quick Response Code (SGQR) specifications, enabling businesses to collect payments via PayNow through the national unified payment QR code, SGQR. The adoption of the

Read More